PRESS RELEASE

Contact:

Frank Knapp Jr.

803-600-6874

fknapp@scsbc.org

Columbia, SC, March 23, 2021 — The number of commercial banks has decreased 68% since 1980. Only 4,600 banks exist today because “many smaller sized banks have disappeared during this period, via mergers or failures” according to a report released this month by the Office of Advocacy.

This federal agency is billed as an independent voice for small business and is housed in, but not for oversight, the US Small Business Administration. The Office of Advocacy has long been criticized for being the mouthpiece for big business interests through its regulatory authority, research, and policy recommendations.

“This report, Effects of Small Loans on Bank and Small Business Growth, is yet another example of the agency’s big-business leanings,” said Frank Knapp Jr., coordinator of Reform the SBA, a business-led campaign that includes proposed changes to the Office of Advocacy.

The report:

• Acknowledges the “importance of small loans for the success” of small businesses.

• Concludes that research results “provide evidence that small business loans…have a statistically and economically significant impact on small business employment growth and small business entry.”

• Estimates that “doubling loans less than $100k is associated with increases in employment by ~ 7 percentage points within one year”.

• Recommends that policies “focused on small business loan availability should be given a high priority because small business loans have large and significant effects on employment growth and job creation.”

The report also points out:

• The “potential risks of relying on large banks to fill in for small banks’ role in providing the small business loans”.

• Large banks view small business loans as “inherently riskier” and requiring “more monitoring”.

Yet, the Office of Advocacy’s recommended solution for more small business loans is still to rely on large banks.

Policies that will encourage banks of all sizes (large ones in particular unless consolidation trends are reversible) to continue to supply small business loans is essential to meet financial needs of small businesses. These policies can be in the form of increasing financial incentives to banks to offer smaller loans…such as extending the scope of small business loan guarantee programs such as the SBA’s 7a program.”

“The Office of Advocacy’s solution to the problem is to do more of the same,” said Knapp who is also the CEO of the South Carolina Small Business Chamber of Commerce. “Experience tells us that loan guarantee programs are nice, but they can’t make any bank do a small business loan if it doesn’t want to.”

“Clearly the Office of Advocacy is still carrying the water for big business, large banks in this case, even after it was scolded by the Government Accountability Office for internal procedural problems that don’t allow the voice of real small businesses to be heard,” said David Levine, Co-founder and President of the American Sustainable Business Council. “Solutions exist for increasing small business loans including more funding for Community Development Financial Institutions and direct small loans from the SBA.”

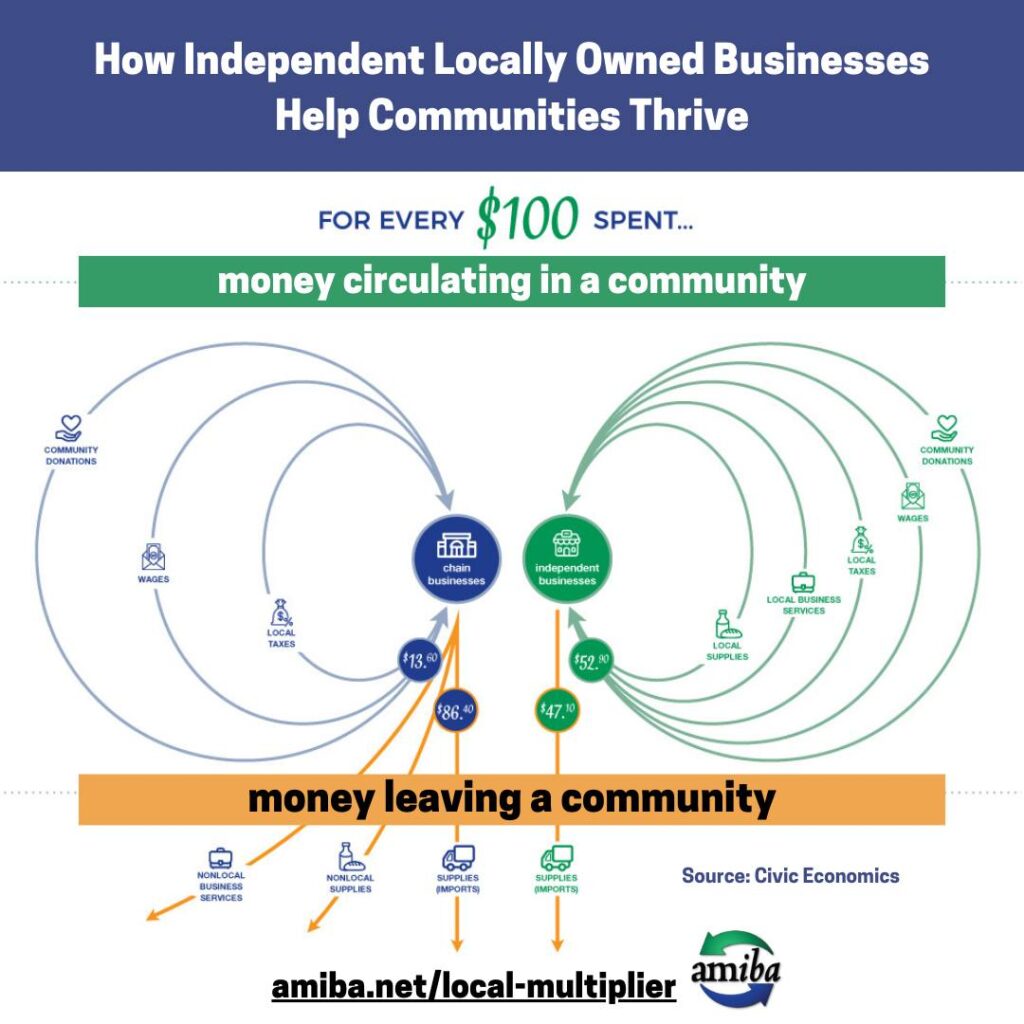

“Funding for the creation and retention of our small and local businesses is critical to building a better, more resilient economy post-pandemic,” said Derek Peebles, Executive Director of the American Independent Business Alliance. “More resources and opportunities are needed to address the systemic challenges small minority-owned businesses face to include non-bank loans, higher levels of government contracting, and more technical assistance-training-coaching”.

The Reform the SBA campaign provides numerous solutions to the access-to-capital problems for entrepreneurs and small businesses.

###