This February, celebrate Choose Black-Owned Month, an annual campaign hosted by the American Independent Business Alliance (AMIBA).

Choose Black-Owned Month hopes to inspire you to support independent Black-owned businesses and celebrate diversity. Since 2022, over 200 partners have joined this campaign—from California to New Hampshire, and from Canada to Texas. While the federal government condemns such efforts, we believe we can still build stronger, diverse, inclusive, and equitable local economies at the grassroots level.

While all entrepreneurs face significant challenges, building a business is even more difficult for Black business owners across the country. Black-owned businesses receive less financing than businesses owned by other races. In 2022, the Federal Reserve reported that 35% of white business owners received all the funding they requested from a bank, compared to 16% of Black business owners.

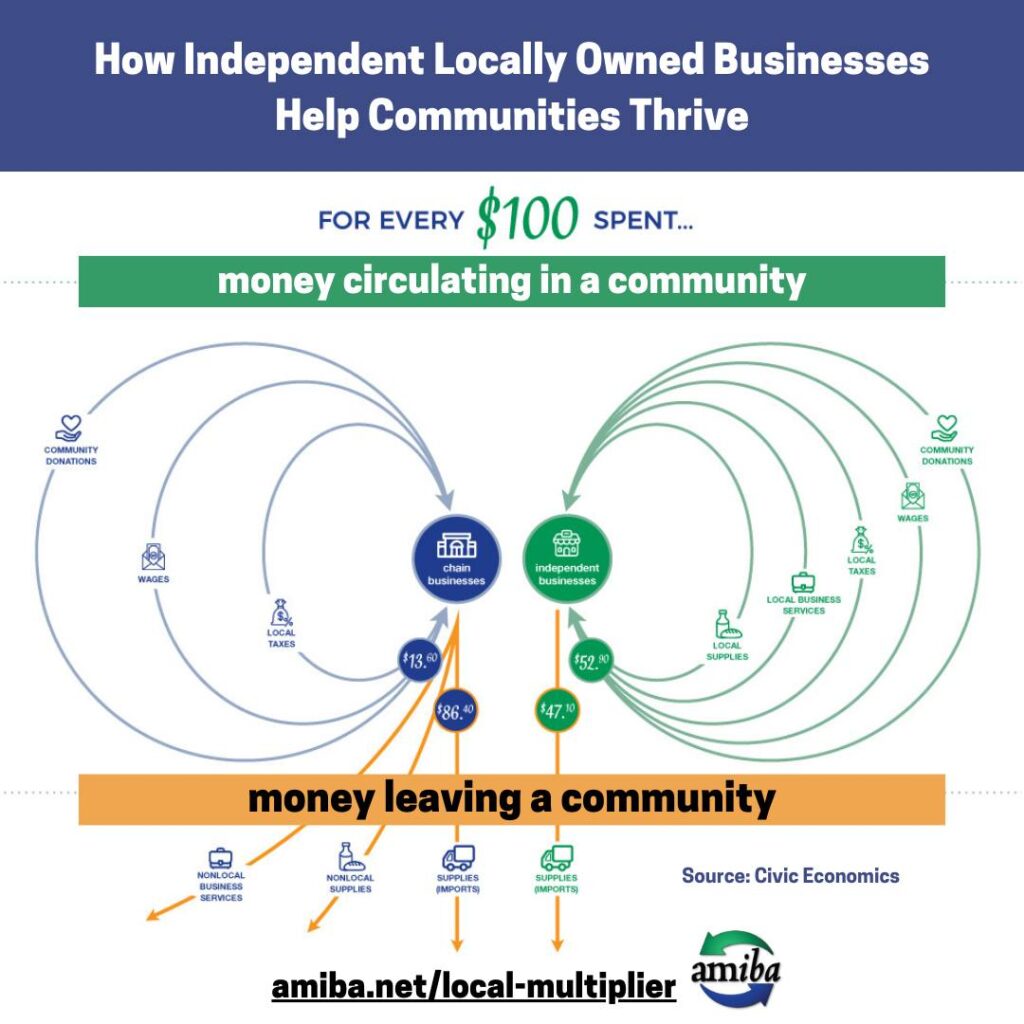

Even when firms have good credit scores, studies show that Black business owners are less likely to receive full funding compared to white-owned firms. This lack of capital holds back revenue growth and employment for that individual business owner and, through the multiplier effect, community wealth building in the broader local economy. One report noted that closing the wealth gap could add $2–$3 trillion in annual growth to the US economy.

Supporting Black-owned businesses does not mean abandoning others; it means working to level the playing field for all. That’s why making a concerted effort to purchase from and invest in Black-owned businesses has such a profoundly positive impact on local communities. Let’s bring some of this work to the surface by highlighting one organization working hard in New England, the Black Farmer Fund.

About the Black Farmer Fund

Since 2020, the Black Farmer Fund (BFF) has invested over $14 million in 14 Black-owned farm and food businesses in New England, intending to deploy $40 million across 75 investments within 10 years.

“When we initially started the organization, we looked at the USDA research,” said Olivia Watkins, Co-Founder and President of the Black Farmer Fund. “When you look at net cash, farm income, for example, in the 2017 numbers, Black farmers were making around negative $906, while other farmers were making $42,000. That was a really stark distance that we saw across the Northeast.”

The organization offers rapid response and capacity-building funds to build a brighter future for Black farmers. An integral part of BFF’s mission is to involve community members in the investment process. Local farmers and food business owners participate in the fund’s selection committees, helping decide who receives capital and other technical assistance.

One of the most exciting things about the Black Farmer Fund is that everyday investors, those shut out of accredited investor-only opportunities, can invest in this fund. That means I can invest $1,000 in BFF at a 3% interest rate for 5 years, putting my money to work for a mission I believe in.

Learn more about investing in the Black Farmer Fund

New England Sweetwater Farm & Distillery in Winchester, NH, represents one of the beneficiaries of the Black Farmers Fund. This family-owned business offers locally made whiskey, vodka, gin, rum, moonshine, and ready-to-drink cocktails.

“Our spirits are cultivated from local products that spur local agriculture and sustainability,” states the distillery’s website. “We ferment and distill ‘on the grain,’ drawing out the subtle, unique flavor profiles of our locally grown ingredients. As a reflection of our dedication to creating superior spirits, our products are crafted in small-scale batches and manufactured using only high-quality food sources.”

Learn more about New England Sweetwater Farm & Distillery

.png)

At AMIBA’s next virtual meeting on Thursday, February 12, at 1 pm, join Olivia Watkins and learn more about how the Black Farmer Fund cultivates a thriving and sustainable food system for people and the planet.

We hope to see you there!