Imagine your money isn’t just a number on a screen but a force that strengthens your local community and economy. By directing our funds to banks and businesses based where we live, we can join a growing movement that prioritizes both people and profit. And local economy organizations across the country are blazing the way.

Local Banking

Kathleen Roark, former Director of Engagement for People First Economy in Michigan, posed the question, “How do my bank accounts fall into the scope of localism?” The buy local message has been present in her home state for a long time. And it’s one that many people have gotten behind. They love spending their dollars at the businesses that make their community unique.

But thinking about our banks and credit unions as local businesses can be a bit of a leap. And Roark wondered if “maybe it doesn’t feel as sexy” to think about local when it comes to where you manage your finances.

In the past, during Move Your Money month in April, People First Economy built up a month-long narrative about broken parts of our larger financial system and the benefits of keeping money closer to home. “But we took a different approach this year because we know post-pandemic, that is not the way that people consume media,” Roark explained.

Instead, the organization attempted to pull the narrative into more bite-sized messages within individual social media posts and newsletters. “Our goal moving forward is really to tell a story with each touchpoint that we have,” Roark noted.

People First saw a boost in their analytics with this approach, as well as steadier interactions throughout the month, not just at the beginning when the theme was most novel. “We received a lot of feedback around: ‘Wow, this is really important. I’ve never thought about this before,'” Roark said.

People First also benefitted from great partnerships, like the one they have with Lake Michigan Credit Union. They elevated the campaign message through radio content and by utilizing elements from the media toolkit People First Economy provided.

Having a single landing page for each annual campaign, like Move Your Money, is key for People First. These pages bring together toolkits, directories, and printable PDF posters for participating businesses to simplify participation.

Prior to launching Move Your Money: Beyond Banking this spring, People First Economy also hosted a webinar focused on this year’s toolkit. The session walked through available resources, how to implement them, and how to champion the campaign’s message.

“We definitely want to bring that back into our other campaign areas,” Roark described. It even proved valuable after the fact, with the recording going out to those who missed the live session and organizations that caught on during Move Your Money.

“We feel like this is a really strong conversation we want to continue bringing back, but the shape, I think, will change every year as we learn more about its power, its success, and how consumers are grasping it— or not,” Roark said.

On the East Coast, Cambridge Local First (CLF) is also feeling the urgency of this message. “We’ve seen a huge shift, unfortunately, toward national banks,” described Theodora Skeadas, Executive Director of CLF in Massachusetts. Much of it comes down to what feels most secure.

“People feel a lot of uncertainty these days and want to feel safe,” Skeadas said. The idea of “too big to fail” can be attractive from a distance, though past events, like the collapse of Silicon Valley Bank, have brought new questions to the table.

That collapse actually took place right before last year’s Move Your Money month, and Skeadas noted, “It was quite a time to be talking about financial institutions.” Thanks to the robust Resilient Economies Internship Program CLF has cultivated over the past several years, they were able to mine a ton of powerful data to help people visualize the impact of community banking. “It’s actually one of our best landing pages,” Skeadas said of this year’s page for Move Your Money.

Staggering stats like this one stand out: “Today, 90% of all deposits are held across only 19 distinct banks.” And the page also links directly to 7 Simple Steps to Move Your Checking Account from the Institute for Local Self-Reliance.

Through a combination of social media posts, newsletters, and community television segments, CLF pushed out the message throughout April, reaching different audiences with each approach. An ongoing project they’re working on this summer with the help of their interns is a program with local banking partners to help college students open new accounts when they arrive in the fall.

“A lot of people open their first accounts when they start college,” Skeadas said. In Cambridge, CLF has many banks and credit unions committed to local for new students to choose from.

Local Investing

The same goes for Rhode Island, where Local Return, an organization that builds community wealth through ownership and investment, also put their creativity to use to promote local banking this year. “There were multiple ways we could come at this message,” described Jessica David, President and Co-Founder of Local Return.

![]()

She said selfishly, Move Your Money is probably one of her favorite campaigns because it feels so concrete, and there’s so much significant data. Evidence illustrates that local banking is very efficient and offers lower fees. Local banks also do more to support and finance local businesses and to contribute to their communities in charitable ways. “We really wanted to try to portray several of those messages,” David explained.

So, they decided to hold a live campaign launch at a culinary incubator called Hope & Main, which had just opened their Downtown Makers Marketplace. “We realized it was such a perfect message because most of the large bank headquarters have moved out of downtown,” David said.

The event also featured an impressive local speaker, Mariana Silva-Buck, owner of Little Maven Lemonade. After connecting with Boston Children’s Hospital at a trade show, the hospital offered to serve Little Maven Lemonade to all their patients. But Silva-Buck needed an infusion of cash to scale up.

“None of the big banks where she had been banking would even consider it,” David described. Instead, Buck turned to People’s Credit Union and obtained financing. “It’s been absolutely game-changing for her business,” David said.

Stories like these drive the local conversation forward in Rhode Island, where David feels people are hungry to know what they can do beyond buying local. “What I love about Move Your Money is it’s actually: Put your money where your mouth is. Where you deposit your money is where it all starts,” she said.

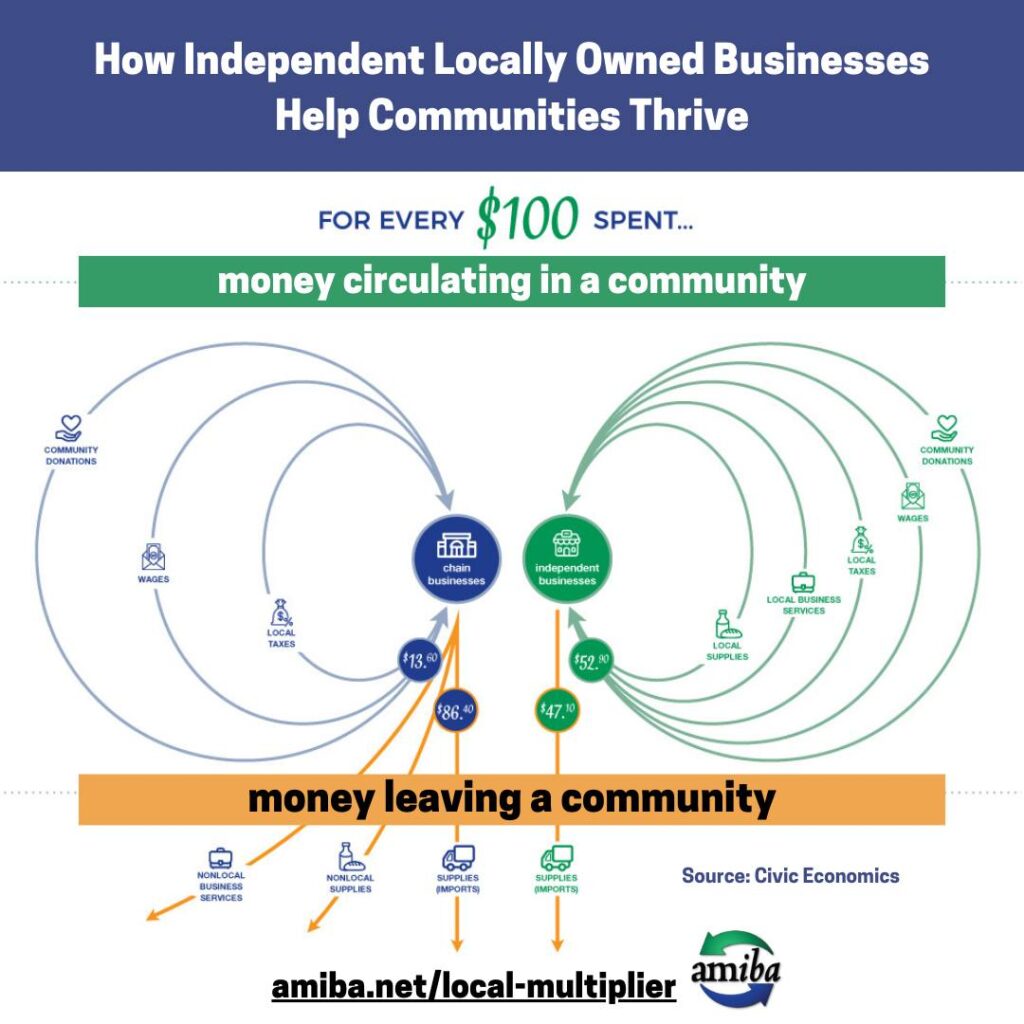

Local Return has put together a Make Your Move toolkit online, using resources from AMIBA and other local first organizations nationwide, particularly Local First Arizona. David said it’s so helpful to get inspired by other people doing this work. “It does feel like a little bit of a leg up.”

Those time-saving resources are particularly valuable for Local Return at this moment, as they direct resources into being one of the first communities in the country to implement a new Diversity Community Investment Fund (DCIF).

“We’re aiming at a $3.5 million fund with a primary focus on real estate and really trying to zoom in on neighborhoods that have experienced disinvestment and economic hardship over many decades and generations,” David described. But the system is complex, and each painstaking decision about governance and execution takes time. However, Local Return leads the way by engaging in this groundbreaking community investment model.

Local investing is one of three key buckets writer, speaker, and “Champion of Social Good” Devin Thorpe keeps top of mind. He specializes in impact crowdfunding, which encompasses local investing, lifting up social and environmental causes, and backing diverse founders.

It’s well known that minorities and women receive significantly less financial investment in business ventures. But did you know that “on average, women do better than white men on crowdfunding in terms of being more likely to hit their fundraising goals?” Thorpe described.

One of his examples came from a small company in Troy, Montana, a town that had a bear problem. In the fall, the large animals would make their way into people’s backyards to eat ripe fruits, particularly apples. A couple of local women entrepreneurs saw an opportunity to solve the problem by getting the fruit off the trees sooner and processing it into spirits with a local distillery.

“They got some great video of a bear in an apple tree delighting himself,” Thorpe recalled. And that powerful video played a significant role in how much support the entrepreneurs received to address this pressing social issue within their community.

Thorpe wants to see more of this happen, so he’s created The Super Crowd Inc. This public benefit corporation hosts virtual and live events to accelerate the impact crowdfunding movement. This type of crowdfunding refers to investments made in companies supporting social or environmental good.

Thorpe said, “Generations of Americans have been taught to believe that direct investing in private companies is too risky. As you know, investing in the stock market is risky enough — and anything else is too risky. And that is a difficult mindset to overcome.”

But The Super Crowd exists to address this problem by helping people learn how to become investors in comfortable, affordable ways. Thorpe knows people are tired of Zoom events and unlikely to pack their suitcases and fly across the country for a single event. So he’s taking Super Crowd on the road.

“We want to get people excited about all of the different ways they can change the world with, you know, 100 bucks at a time,” he explained. He advises people new to local investing: “As scary as it is, the first thing to do is to make an investment in a crowdfunding campaign.” He suggested checking out the backstory of each company you’re interested in to determine its viability and then putting your dollars where they count.

Two websites specializing in local investment offerings are Honeycomb Credit and SMBX, both of which Thorpe said are good for learning. Crowdfund Mainstreet is another one he likes, particularly because it’s built with social impact in mind. These sites have also created mechanisms for zero-cost investing, “So you put your ten bucks in no fees, you get your ten bucks out eventually with interest, and that’s pretty cool,” Thorpe said.

Learn more about our Move Your Money: Bank Local, Invest Local Campaign and sign on as a partner today — it’s free!